Jefferies just launched coverage of the quantum computing sector with a bullish call, sending IonQ (IONQ) shares surging. The firm slapped a $100 price target on IONQ stock, implying roughly 110% upside from current levels, while initiating with a “Buy” rating.

IonQ develops trapped-ion quantum computers designed to solve complex problems across business, society, and scientific research. Founded on 25 years of academic research, the company uses ionized atoms to perform longer, more sophisticated calculations with fewer errors than competing quantum systems.

IonQ is the first quantum hardware provider integrated with all major cloud platforms, offering accessible quantum computing through partnerships with Amazon's (AMZN) AWS, Microsoft's (MSFT) Azure, and Alphabet's (GOOG) (GOOGL) Google Cloud for applications in chemistry, medicine, finance, and logistics optimization.

Analyst Kevin Garrigan expects IonQ to benefit from powerful ecosystem tailwinds driving quantum computing adoption. The company's trapped-ion architecture differentiates in coherence, fidelity, and native all-to-all connectivity, technical advantages that matter as the technology matures.

IonQ's roadmap targets fault-tolerant quantum computing with integrated 256 qubits by 2026, scaling to 10,000 physical qubits and 800 logical qubits in 2027, and ultimately 2 million physical qubits with 80,000 logical qubits by 2030.

Is IONQ Stock a Good Buy Right Now?

IonQ delivered a stunning third quarter, solidifying its position as the dominant force in quantum computing. It reported revenue of almost $40 million, beating its guidance by 37% and growing 222% year-over-year (YoY).

The Q3 results showcased IonQ's expanding quantum platform strategy, encompassing computing, networking, sensing, and cybersecurity capabilities that no competitor can match.

IonQ's fifth-generation Tempo system achieved an algorithmic qubit score of 64, creating a computational space 36 quadrillion times larger than IBM's (IBM) leading commercial system. More significantly, the company demonstrated a world-record 99.99% two-qubit gate fidelity, meaning IonQ has hit every key technical milestone needed for full fault tolerance.

IonQ's acquisition spree is proving transformative. The Oxford Ionics deal closed during the quarter, bringing Electronic Qubit Control technology that leverages standard semiconductor fabrication.

This matters enormously because IonQ can now manufacture quantum chips using mature 128-nanometer nodes at existing foundries rather than building custom infrastructure that would cost billions. The bill of materials for a 2-million-qubit machine comes in at under $30 million, much lower than competitors.

Vector Atomic's addition expands IonQ's total addressable market into quantum sensing for positioning, navigation, and timing applications critical to defense customers. With quantum key distribution capabilities from the ID Quantique acquisition, IonQ can now bid on massive Golden Dome-style infrastructure projects that require integrated quantum solutions.

The business is rapidly globalizing, with international revenue accounting for 30% of total sales, up from nearly zero a year ago. Government and enterprise partnerships validate commercial viability, while the company expands beyond pure compute into quantum networking and sensing applications.

What Is the IONQ Stock Price Target?

Guidance for full-year 2025 revenue increased to $106 million to $110 million, breaking historical seasonality patterns as fourth-quarter revenue is expected to exceed the third quarter.

The company's 256-qubit system launches in 2026, followed by a roadmap that reaches 80,000 logical qubits by 2030, compared with IBM's stated target of just 2,000 logical qubits by 2033.

Analysts tracking the quantum computing stock forecast revenue to increase from $108.5 million in 2025 to $746 million in 2029. Despite this significant top-line growth, IONQ is expected to remain unprofitable. Over the next four years, its free cash outflow is projected to surpass $1.2 billion.

IonQ raised $2 billion in October at $93 per share, bringing the pro forma cash balance to $3.5 billion with zero debt. This war chest positions the company to continue aggressive investment in maintaining what management describes as a five-year technical lead over competitors.

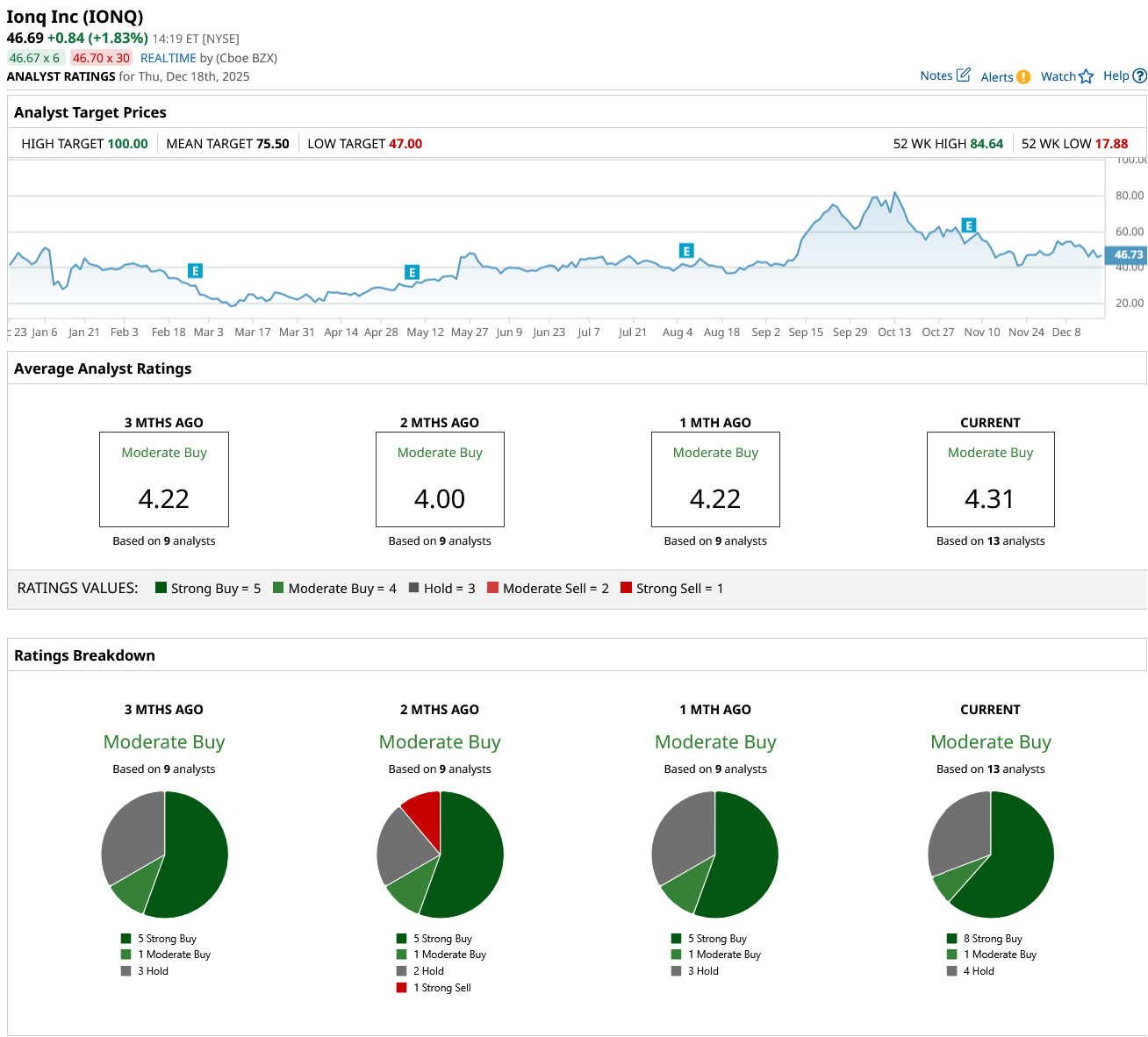

IONQ stock has been volatile, down about 40% from October highs alongside the broader quantum computing selloff. Yet Wall Street remains overwhelmingly bullish, with 75% of analysts recommending IonQ.

Out of the 13 analysts covering IONQ stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and four recommend “Hold.” The average IONQ stock price target is $75.50, above the current price of $47.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- iRobot Just Filed for Bankruptcy. What Does That Mean for IRBT Stock? And Why Have Investors Been Chasing Shares Higher?

- Chip Stocks Are No Longer an Automatic Path to Profits. What the Numbers Say About This Key Semi ETF Now.

- As Robinhood Moves Into Sports Betting, Should You Buy, Sell, or Hold HOOD Stock?

- Wall Street Loves This Software Stock for 2026. Should You Buy It Now?