Medical device company Integra LifeSciences (NASDAQ:IART) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $415.6 million. The company expects next quarter’s revenue to be around $415 million, close to analysts’ estimates. Its non-GAAP profit of $0.45 per share was 4.4% above analysts’ consensus estimates.

Is now the time to buy Integra LifeSciences? Find out by accessing our full research report, it’s free.

Integra LifeSciences (IART) Q2 CY2025 Highlights:

- Revenue: $415.6 million vs analyst estimates of $395 million (flat year on year, 5.2% beat)

- Adjusted EPS: $0.45 vs analyst estimates of $0.43 (4.4% beat)

- Adjusted EBITDA: $71.22 million vs analyst estimates of $66.75 million (17.1% margin, 6.7% beat)

- The company dropped its revenue guidance for the full year to $1.67 billion at the midpoint from $1.68 billion, a 0.9% decrease

- Management reiterated its full-year Adjusted EPS guidance of $2.24 at the midpoint

- Operating Margin: -123%, down from 11.3% in the same quarter last year largely due to $511 million one-time impairment charge

- Free Cash Flow was -$11.23 million, down from $10.69 million in the same quarter last year

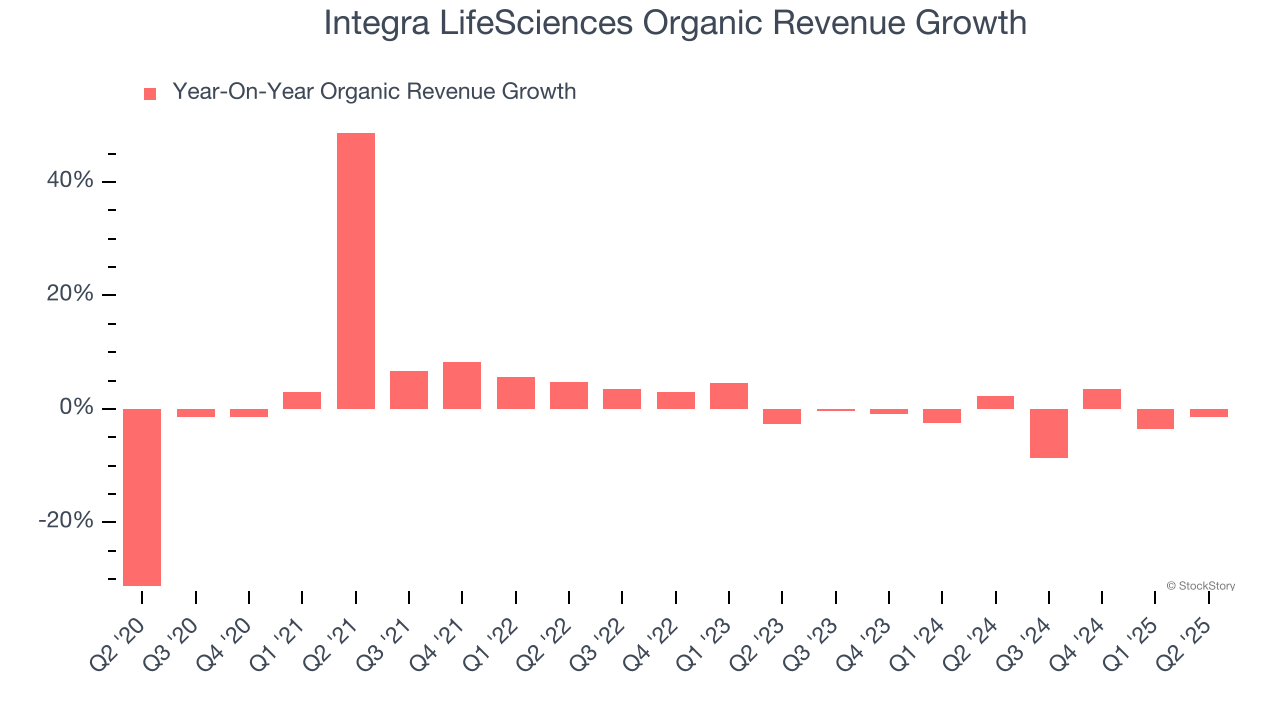

- Organic Revenue fell 1.4% year on year (2.3% in the same quarter last year)

- Market Capitalization: $961.3 million

“I am proud of our team’s performance and execution in the second quarter. Our strong revenue performance is a testament to our disciplined progress and the solid underlying demand trends for our portfolio of neurosurgery and tissue technology products,” said Mojdeh Poul, president and chief executive officer.

Company Overview

Founded in 1989 as a pioneer in regenerative medicine technology, Integra LifeSciences (NASDAQ:IART) develops and manufactures medical technologies for neurosurgery, wound care, and surgical reconstruction, including regenerative tissue products and surgical instruments.

Revenue Growth

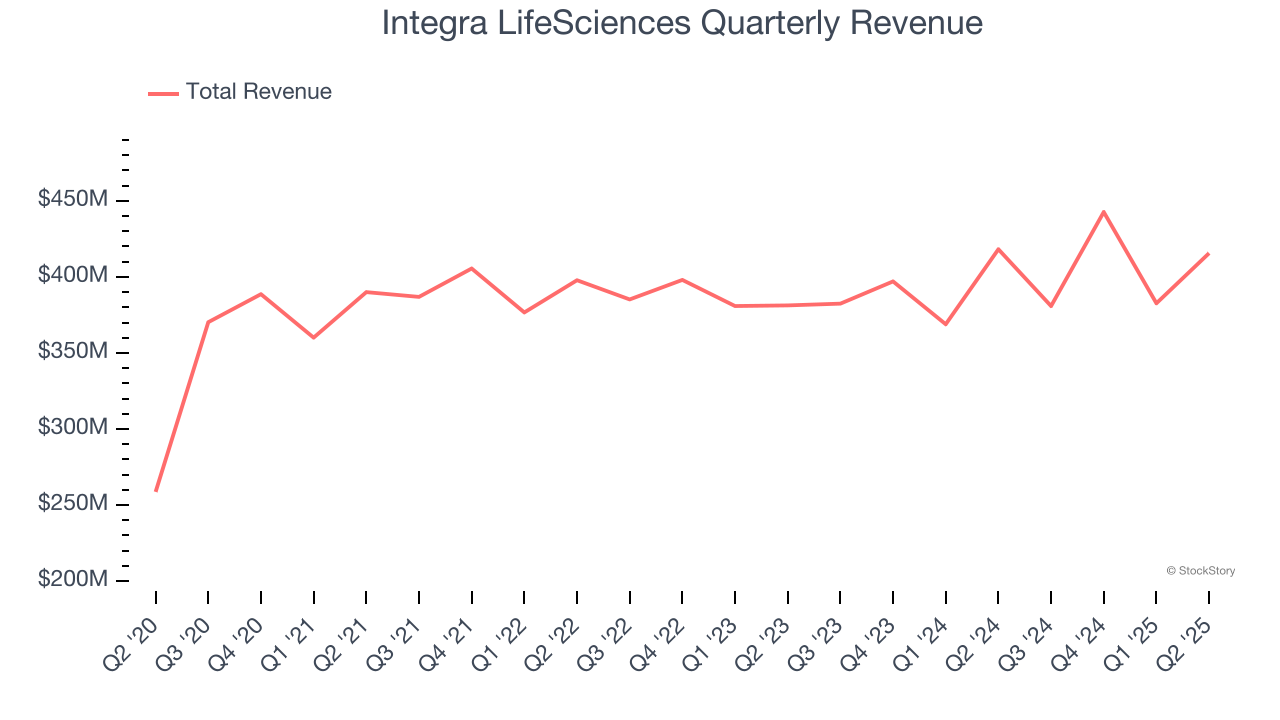

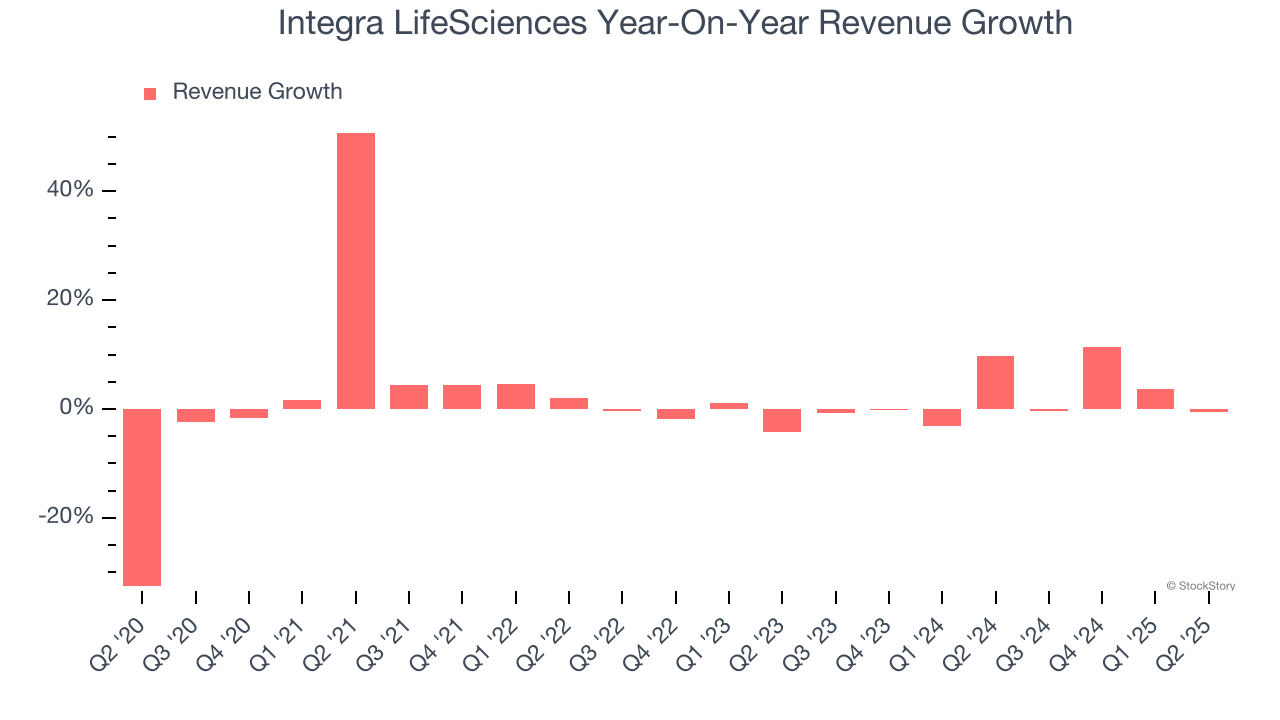

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Integra LifeSciences’s sales grew at a tepid 3.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Integra LifeSciences’s annualized revenue growth of 2.4% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Integra LifeSciences’s organic revenue averaged 1.4% year-on-year declines. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Integra LifeSciences’s $415.6 million of revenue was flat year on year but beat Wall Street’s estimates by 5.2%. Company management is currently guiding for a 9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

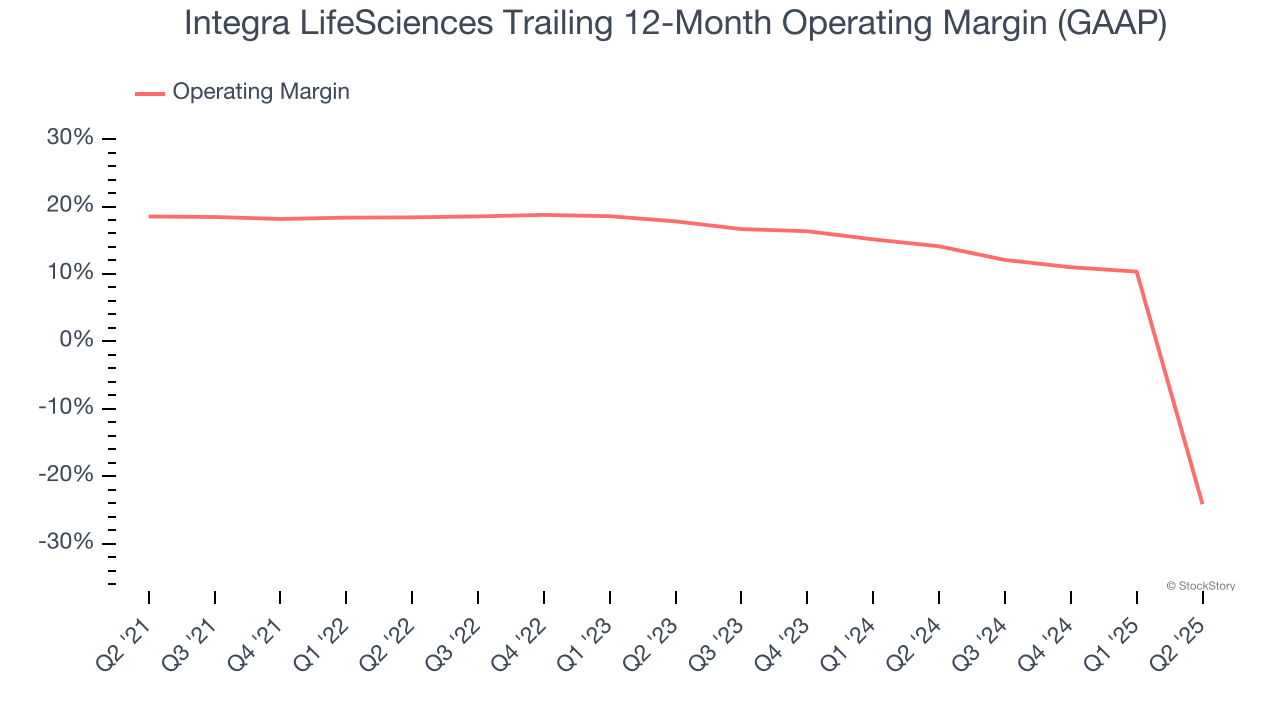

Integra LifeSciences was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.6% was weak for a healthcare business.

Analyzing the trend in its profitability, Integra LifeSciences’s operating margin decreased by 42.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 42 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Integra LifeSciences generated an operating margin profit margin of negative 123%, down 134.6 percentage points year on year largely due to a $511 million one-time impairment charge.

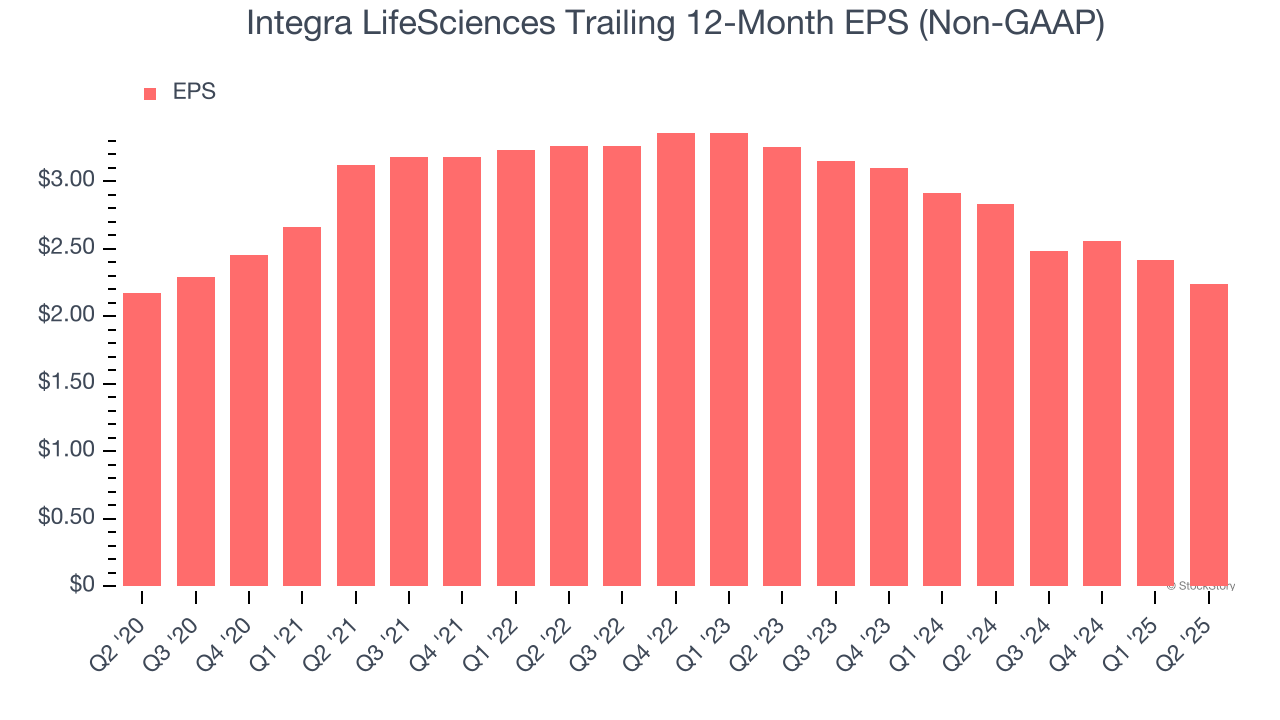

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Integra LifeSciences’s flat EPS over the last five years was below its 3.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Integra LifeSciences’s earnings to better understand the drivers of its performance. As we mentioned earlier, Integra LifeSciences’s operating margin declined by 42.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Integra LifeSciences reported adjusted EPS at $0.45, down from $0.63 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Integra LifeSciences’s full-year EPS of $2.24 to grow 9%.

Key Takeaways from Integra LifeSciences’s Q2 Results

We were impressed by how significantly Integra LifeSciences blew past analysts’ organic revenue expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for the full year was lowered, which is never a good sign. Overall, this print was weaker. The stock remained flat at $12.40 immediately after reporting.

So do we think Integra LifeSciences is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.