Local television broadcasting and media company Gray Television (NYSE:GTN) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 6.5% year on year to $772 million. On the other hand, next quarter’s revenue guidance of $742.5 million was less impressive, coming in 5.1% below analysts’ estimates. Its GAAP loss of $0.71 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Gray Television? Find out by accessing our full research report, it’s free.

Gray Television (GTN) Q2 CY2025 Highlights:

- Revenue: $772 million vs analyst estimates of $771.6 million (6.5% year-on-year decline, in line)

- EPS (GAAP): -$0.71 vs analyst estimates of -$0.30 (significant miss)

- Adjusted EBITDA: $169 million vs analyst estimates of $159.8 million (21.9% margin, 5.7% beat)

- Revenue Guidance for Q3 CY2025 is $742.5 million at the midpoint, below analyst estimates of $782.6 million

- Operating Margin: 10.6%, down from 18.4% in the same quarter last year

- Free Cash Flow Margin: 19.2%, up from 0.9% in the same quarter last year

- Market Capitalization: $444.1 million

Company Overview

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

Revenue Growth

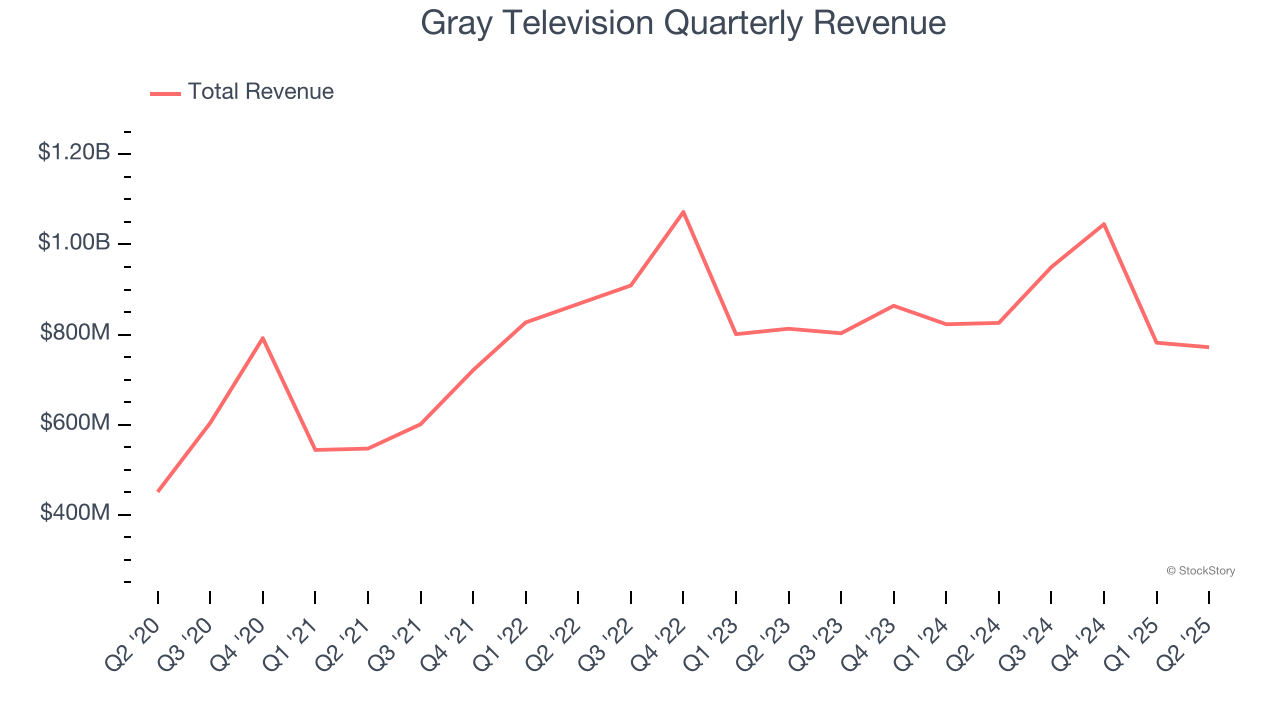

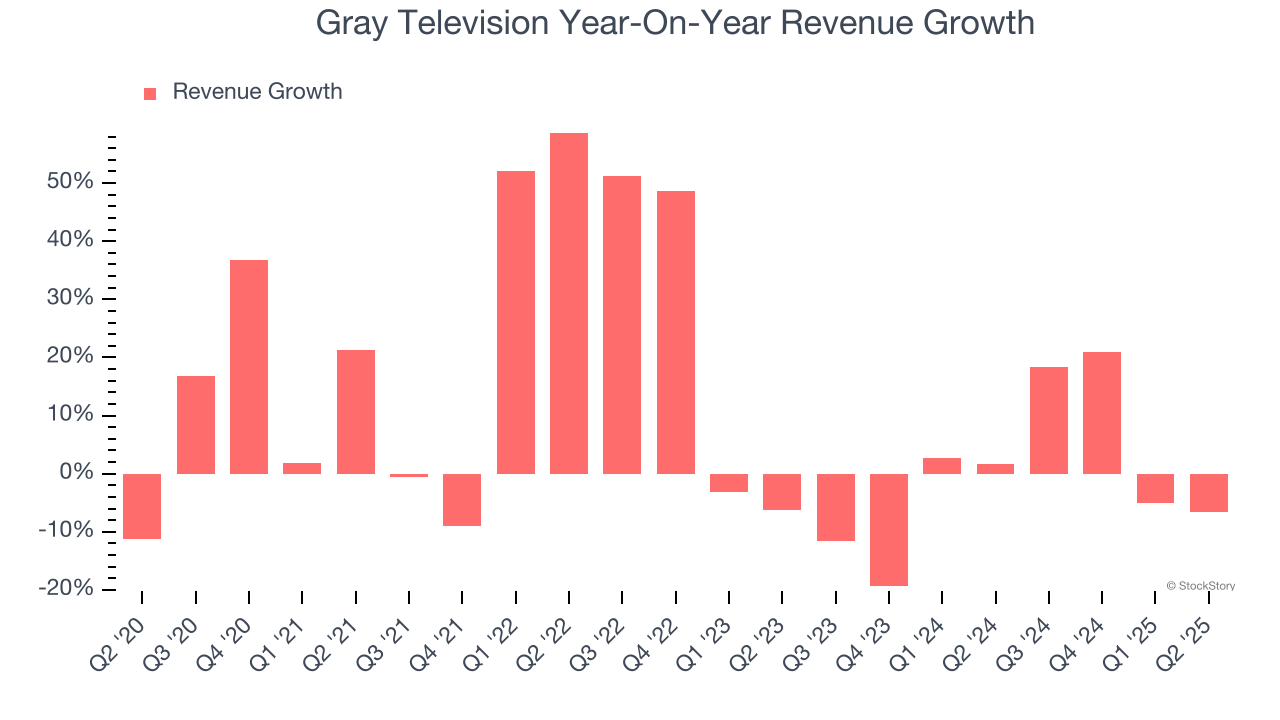

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Gray Television grew its sales at a 11.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Gray Television’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

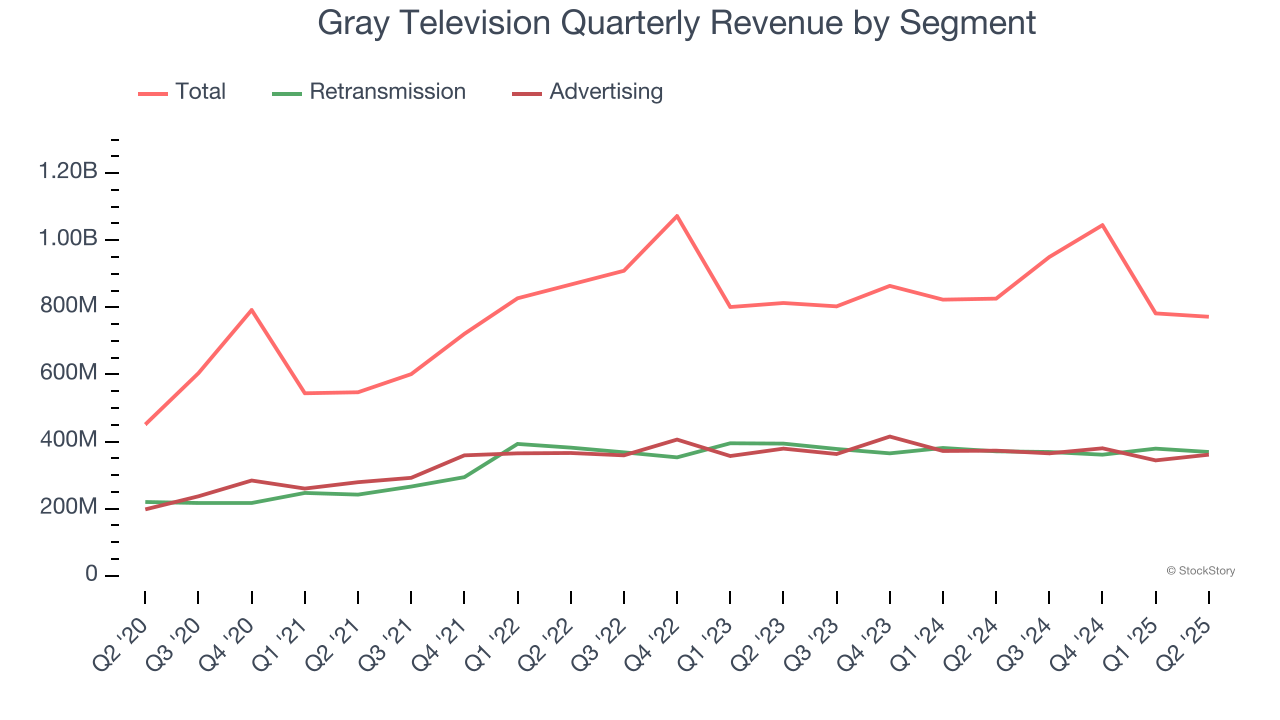

Gray Television also breaks out the revenue for its most important segments, Retransmission and Advertising, which are 47.8% and 46.8% of revenue. Over the last two years, Gray Television’s Retransmission revenue (affiliate and licensing fees) was flat while its Advertising revenue (marketing services) averaged 1.6% year-on-year declines.

This quarter, Gray Television reported a rather uninspiring 6.5% year-on-year revenue decline to $772 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 21.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 8.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

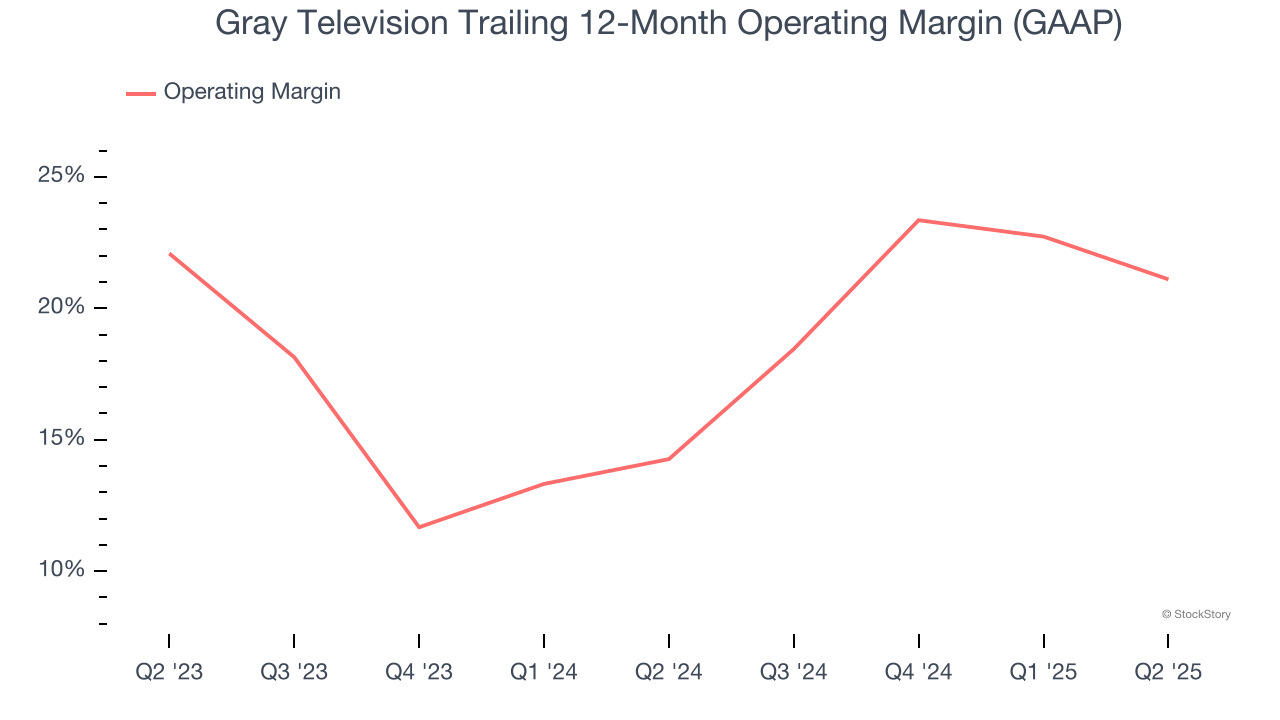

Gray Television’s operating margin has risen over the last 12 months and averaged 17.8% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Gray Television generated an operating margin profit margin of 10.6%, down 7.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

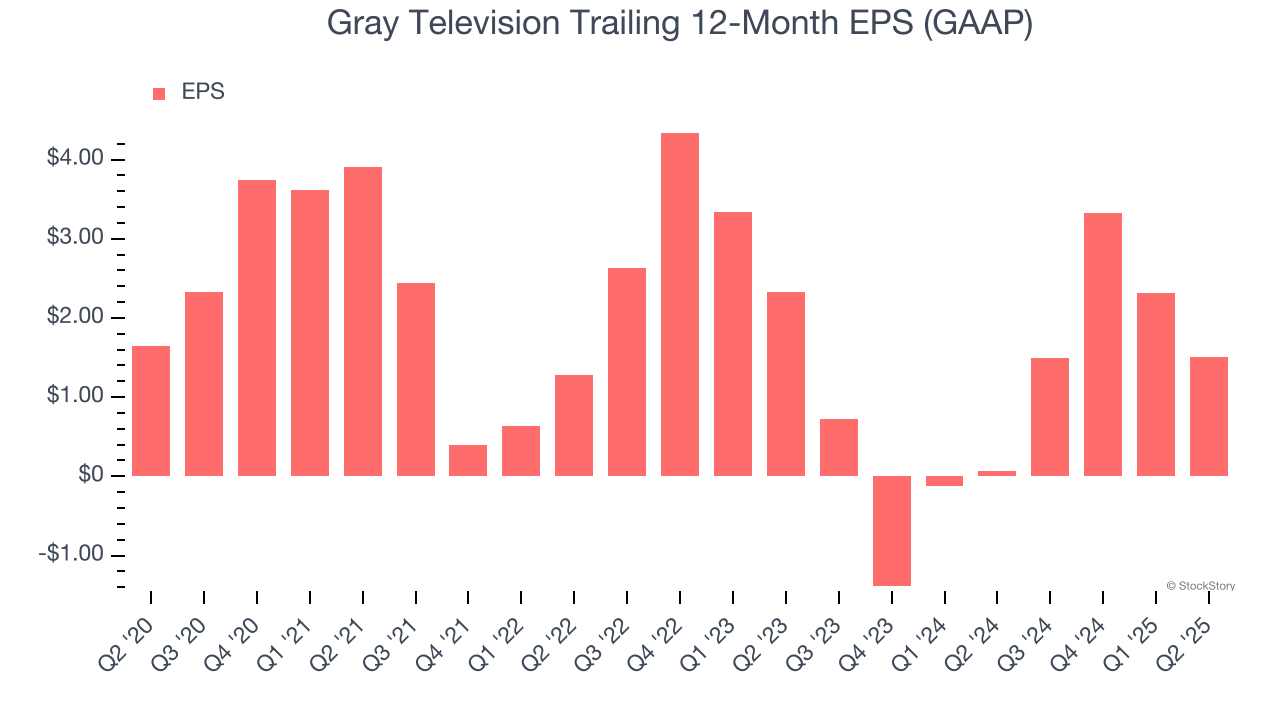

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Gray Television, its EPS declined by 1.8% annually over the last five years while its revenue grew by 11.3%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q2, Gray Television reported EPS at negative $0.71, down from $0.09 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Gray Television to perform poorly. Analysts forecast its full-year EPS of $1.51 will invert to negative negative $0.60.

Key Takeaways from Gray Television’s Q2 Results

It was encouraging to see Gray Television beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 2.9% to $4.29 immediately after reporting.

So should you invest in Gray Television right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.