Restaurant technology provider PAR Technology (NYSE:PAR) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 43.8% year on year to $112.4 million. Its non-GAAP profit of $0.52 per share decreased from $1.59 in the same quarter last year.

Is now the time to buy PAR Technology? Find out by accessing our full research report, it’s free.

PAR Technology (PAR) Q2 CY2025 Highlights:

- Revenue: $112.4 million vs analyst estimates of $111 million (43.8% year-on-year growth, 1.3% beat)

- Adjusted EBITDA: $5.54 million vs analyst estimates of $5.45 million (4.9% margin, 1.6% beat)

- Operating Margin: -15.4%, up from -26.5% in the same quarter last year

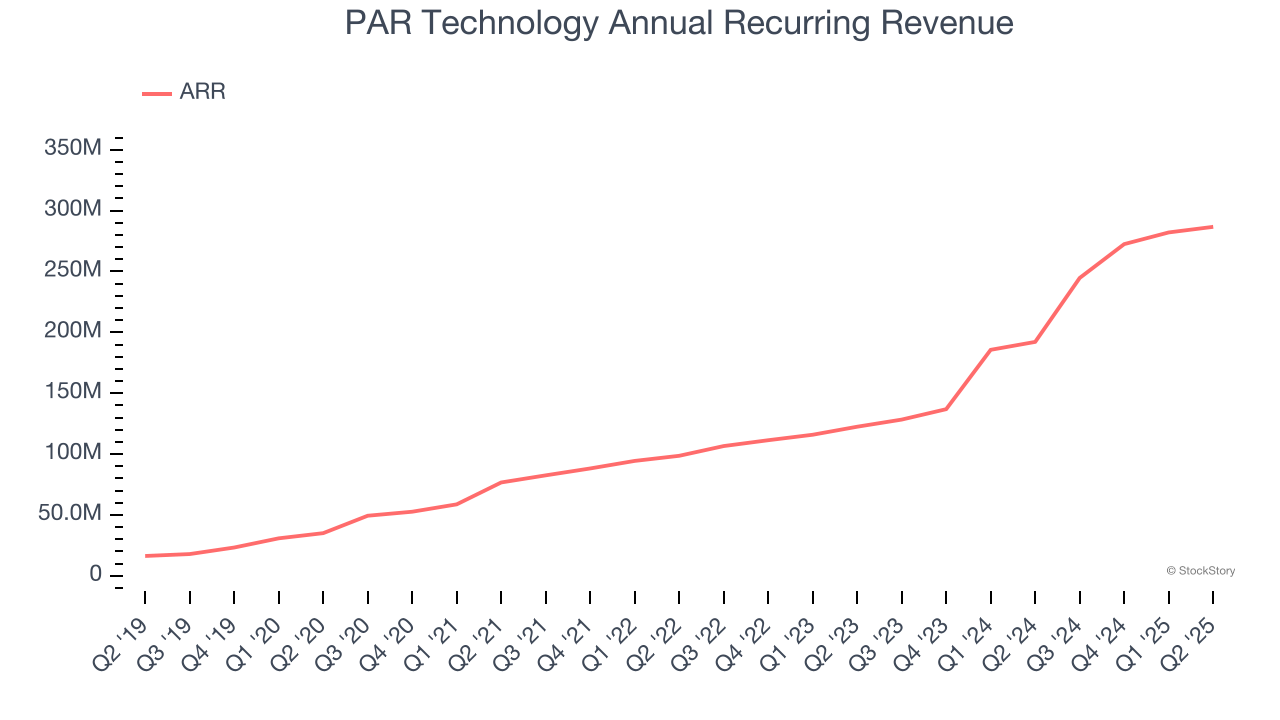

- Annual Recurring Revenue: $286.7 million at quarter end, up 49.2% year on year

- Market Capitalization: $2.35 billion

“Q2 was another strong quarter in proving out our "Better Together" thesis.

Company Overview

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE:PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

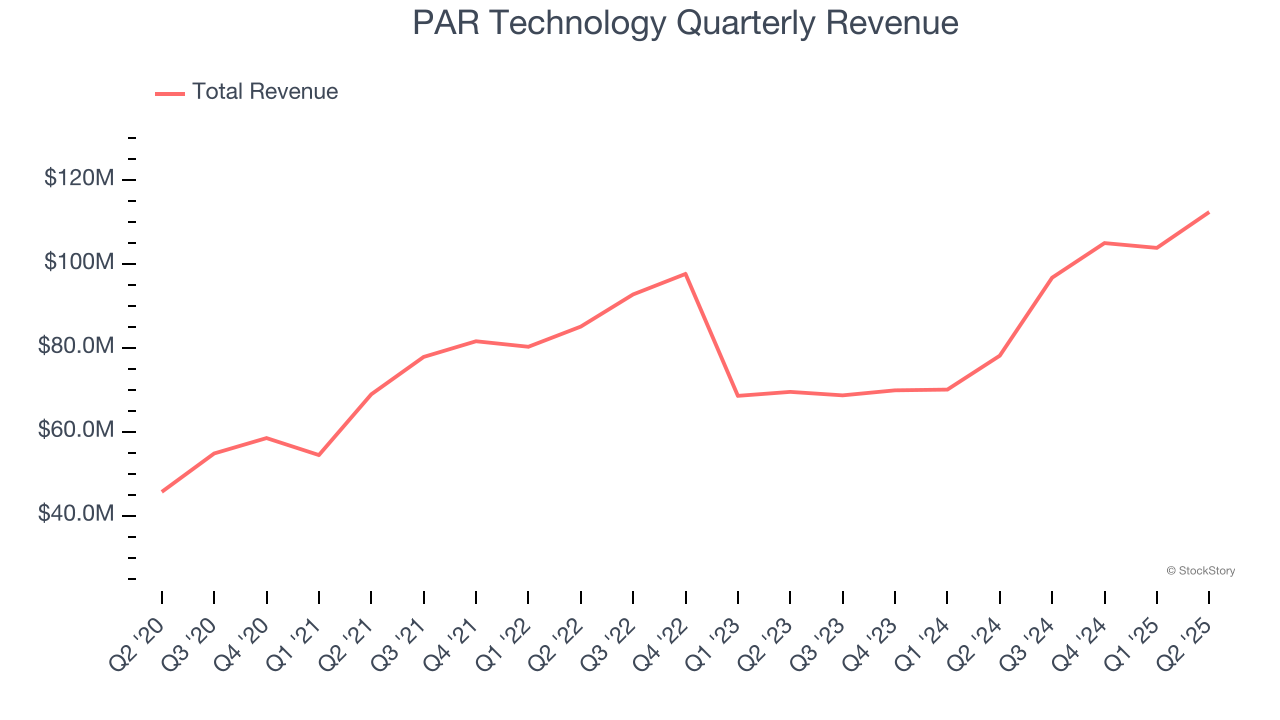

With $418 million in revenue over the past 12 months, PAR Technology is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

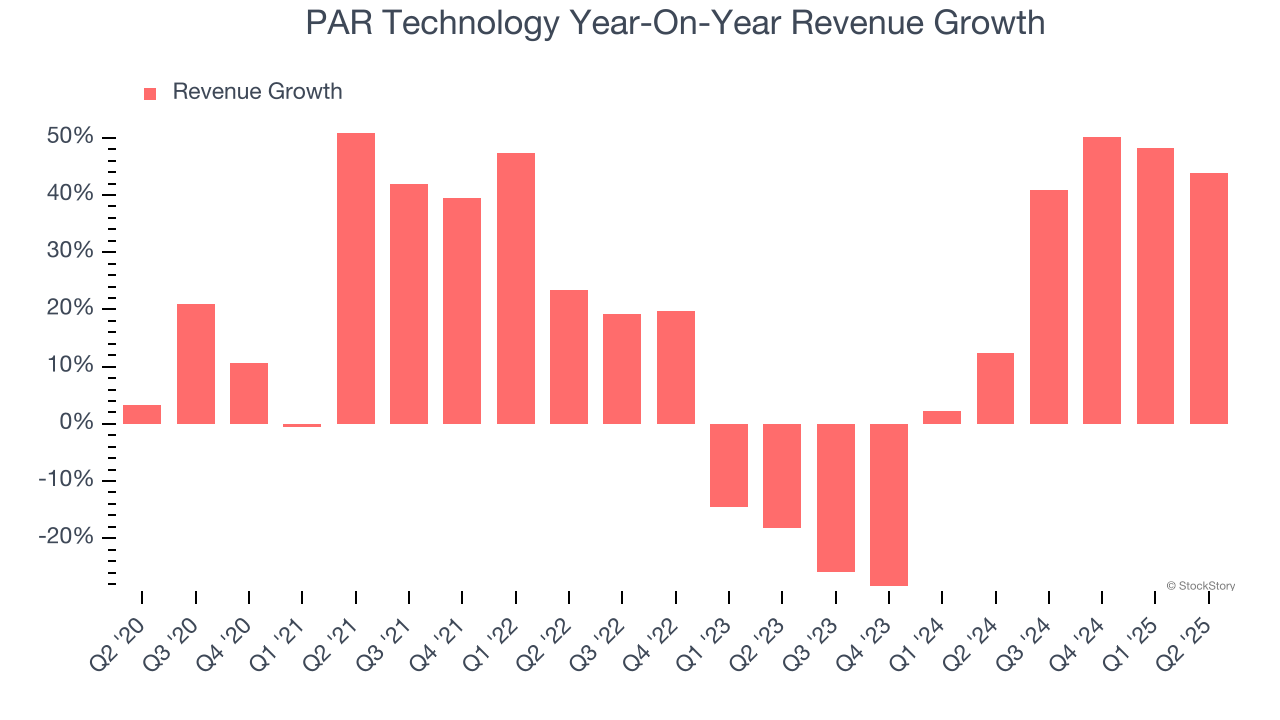

As you can see below, PAR Technology grew its sales at an incredible 16% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. PAR Technology’s annualized revenue growth of 12.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s sales dynamics by analyzing its annual recurring revenue (ARR), or the revenue it expects to generate from its existing customer base in the next 12 months. PAR Technology’s ARR reached $286.7 million in the latest quarter and averaged 56.4% year-on-year growth over the last two years. Because this number is better than its normal revenue growth, we can see the company generated more revenue from its existing customers than new customers. Holding everything else constant, this is a positive sign as it should lead to lower sales and marketing expenses.

This quarter, PAR Technology reported magnificent year-on-year revenue growth of 43.8%, and its $112.4 million of revenue beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 17.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

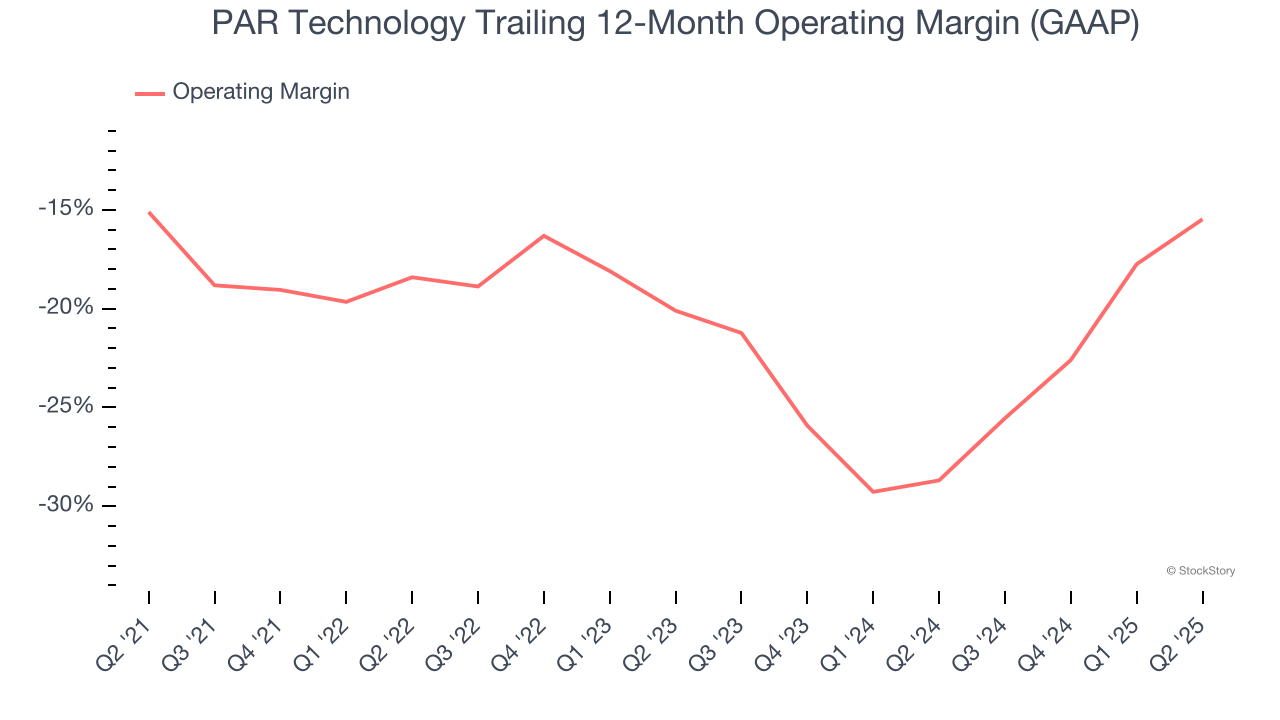

Operating Margin

PAR Technology’s operating margin has risen over the last 12 months, but it still averaged negative 19.3% over the last five years. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

Analyzing the trend in its profitability, PAR Technology’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, PAR Technology generated a negative 15.4% operating margin.

Earnings Per Share

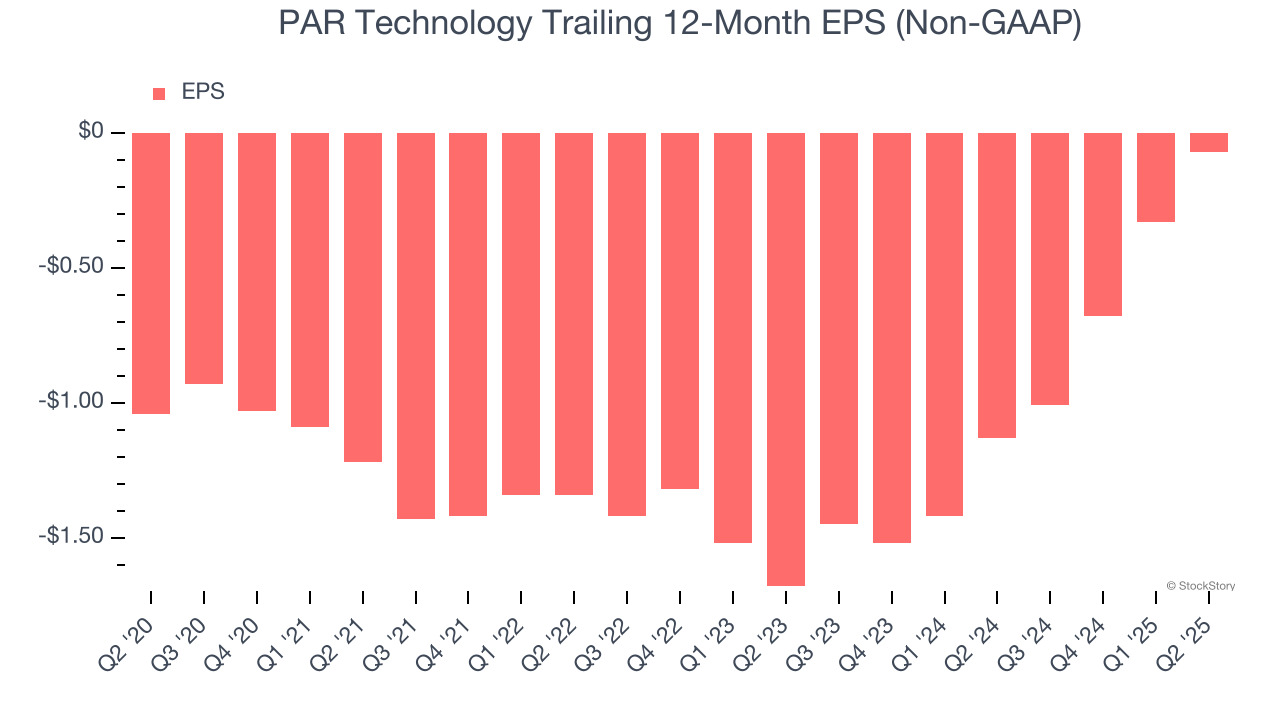

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although PAR Technology’s full-year earnings are still negative, it reduced its losses and improved its EPS by 41.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For PAR Technology, its two-year annual EPS growth of 79.6% was higher than its five-year trend. We love it when earnings improve, but a caveat is that its EPS is still in the red.

In Q2, PAR Technology reported adjusted EPS at $0.03, up from negative $0.23 in the same quarter last year. Over the next 12 months, Wall Street is optimistic. Analysts forecast PAR Technology’s full-year EPS of negative $0.07 will reach break even.

Key Takeaways from PAR Technology’s Q2 Results

It was good to see PAR Technology narrowly top analysts’ revenue and EBITDA expectations this quarter. On the other hand, its ARR missed. Overall, this was a mixed quarter. The stock traded up 3.5% to $59.97 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.